Living in a digital age offers valuable tools to the online user. For example, with just the tap of a finger or a click of the mouse, we now can instantly get access to just about any service you may be interested in. Technology has officially changed the way we shop by making it much more convenient. Due to this it’s become easier and quicker to compare companies online in order to find the best deals than ever before.

In this article we’ll focus on how effective using an online service can be to find cheap auto insurance quotes. Comparing multiple services before your next policy renewal will help you make sure your rate is lowered, without sacrificing coverage. It’s a financially harmful practice to be in the habit of blindly accepting your current insurance renewal at the end of the policy. Just by comparing as little as 3 insurance providers you can get a quote for $70, $100 and $150 with all having the same coverage! The simple reason for this is that some insurance companies offer better rates than others to remain competitive. Before renewing your next policy use these 3 key observations and save your hard-earned money for yourself.

1. Car Insurance Basics

Most people don’t know about insurance as much as they should. It’s common knowledge that it is required by law to own and drive a vehicle, but what else? Auto insurance is protection against anything that might financially impact you with your vehicle. Whether it’s an accident with another car, or a slick road causes you to lose control and need towing. The possibilities are broad but in the end it’s damage to your vehicle and possibly yourself. You could even have your vehicle damaged from natural events or broken into. Auto insurance protects you and the coverage you require can be drastically different than your friends or co-workers. These factors include what state you reside in, age, driving record, credit, and even vehicle. The more risk there is of damage or theft to your vehicle, because of where you live, how you drive, or other factors, the higher your rate will be.

2. Coverage Types

Your rate greatly depends on the type of coverage you require. Liability insurance protects you financially if you’ve caused an accident where someone was injured or damage to someone else’s property. This is very important to consider if you drive to work in a highly populated city where accidents are prone. Since the liability for these damages could sometimes be in the hundreds of thousands of dollars. A guideline that’s recommended for proper protection is having liability insurance that covers your approximate net worth. Liability coverage has three layers: A) Amount covered for damages caused, B) Amount covered for each person injured, C) Amount covered for your own car and passengers. This insurance can be neglected but you should decide the level of coverage you want. Keep in mind it can vary from as low as $50,000 per injured person to as high as millions!

Additionally there’s comprehensive and collision, which is always recommended. However, if you don’t drive often like to and from work you can consider not getting it. As mentioned before, it greatly depends on the state you live in. For example, comprehensive and collision can average a monthly cost of $93 in Illinois, but $193 in Florida. If your state has a low average you might as well get it, and the states with higher averages are due to high volume of these claims. The collision protects you from car accidents where it is neither your fault or the other driver, and if it is your fault. Whereas the comprehensive protects you from theft, vandalism and weather damages.

Keep in mind if you want a higher deductible, then your rates could be lower. The higher the deductible the more you have to pay before the insurance company steps in to pay the remaining cost. If you choose a high deductible to save on low rates, then have an emergency fund since you will likely pay for damages out of pocket. Thoroughly think about which of these insurances makes sense for your life and your car use. Generally the less frequent you drive the less coverage you will probably need, especially if you are a very good driver.

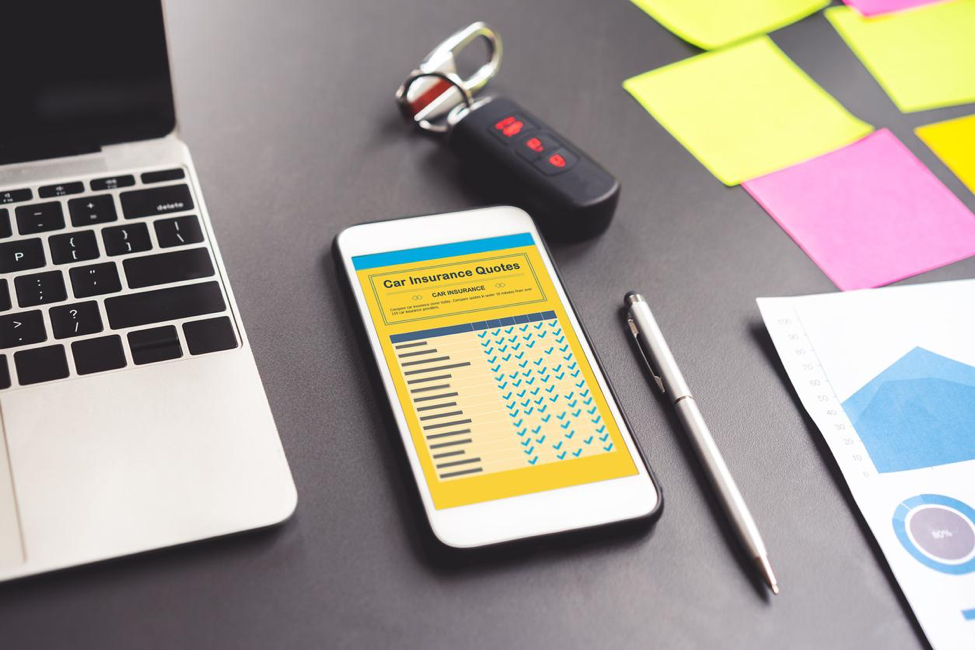

3. Comparing Rates Online – Compare Online Quotes

Before it comes time to renew your policy, check online to make sure you’re not overpaying. It is extremely easy and quick to compare insurance companies and get quotes to review. Your costs could be reduced by 50% or more just by switching insurance companies with the same coverage. Finding better rates for your automobile insurance depends on doing as much research as possible. There are deals out there and using the service www.autoinsurance.org will help you find them. While in the past you may have had to pick up the phone and call every provider or fill out many online forms, however that’s no longer the case. All of your research can be done for you by an online service as recommended above. You complete a few basic steps and get results for many different providers with quotes and policies. Then when you’ve reviewed the results you can reach out to the company to confirm the rate and sign the policy.

Keep in mind tips you can relay such as; storing your car in a garage, good grades if a student, and countless other factors that might reduce your rate.

Final Notes

There are a lot of factors to consider when choosing your policy requirements. Regardless, the best part is that an online service can do that thinking for you and offer the choices for easy comparison. Once you’ve weighed all of the details mentioned above, the service will scour the web for different insurance coverages and display them to you in an instant. Many people are paying more than they need to simply because they haven’t done the work of comparing their current insurance rates to others that might be out there. By shopping online for the best deals, you can find big savings without making tons of phone calls.

Laila Azzahra is a professional writer and blogger that loves to write about technology, business, entertainment, science, and health.